Average/Co-insurance

Material Damage (covering non-residential property) Insurances

These policies often contain an Average / Co-insurance clause which means that you must insure for the full value of the property Insured. If you under-insure, your claim will be reduced in proportion to the amount of the under-insurance.

A simple example illustrating the basic principle, application and effect of the Average / Co-Insurance clause is as follows:

Full (Replacement) Value $1,000,000

Sum Insured $ 500,000

Therefore you would be self insured for 50% of the full value.

Amount of Claim, say $ 100,000

Amount payable by Insurers as a result

of the application of Average/Co-Insurance $ 50,000

(being 50% of the $100,000)

Then, deduct the policy excess, say $ 1,000

Total claim payment $ 49,000

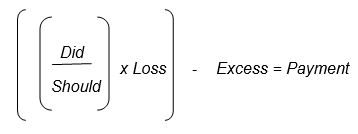

An easy way to remember this clause is:

Did = Amount of Insurance taken

Should = Amount of Insurance required

Click here for more information on the risks of under-insurance.

Business Interruption Insurances

Some policies contain an Average/Co-Insurance clause which is fully set out in the “Basis of Cover” or “Policy Specification” of the policy. For the types of cover most usually provided, the Average/Co-Insurance calculation is arrived at by applying the Rate of Gross Profit, Revenue or Rentals (as applicable) to the Annual Turnover, Revenue or Rentals (as applicable); these factors first being appropriately adjusted as provided for in the “Trend of Business” or “Other Circumstances” clauses.

If you are in any doubt regarding this clause insofar as how this clause applies to Material Damage (Property) &/or Business Interruption policies, please contact our office for assistance.